pay property tax las vegas nevada

Return to the city of Las Vegas portal. Enter your Nevada Tax Pre-Authorization Code.

J2 Residence 7 Sable Ridge Ct Las Vegas Nevada Floor Plans Floor Plans Modern House Residences

American Rescue Plan Act.

. The low rate on property taxes is one of the main. Please visit this page for more information. - 530 pm Monday through Thursday except for holidays.

1st Quarter Tax Due - 3rd Monday of August. Las Vegas NV 89155-1220. 702-229-6011 TTY 7-1-1 An All-America City 2022 lasvegasnevadagov.

Select an address below to learn more about the property such as who lives and owns property on this street home owners contact details tax. Las Vegas NV 89101 Phone. The Clark County Treasurer provides an online payment portal for you to pay your property taxes.

2nd Quarter Tax Due - 1st Monday of October. Review filing payment history. While tourists come to Nevada to gamble and experience Las Vegas residents pay no personal income tax and the state offers no corporate tax no franchise tax and no inventory taxThe Silver State does have a 685 sales tax and also collects fees most of them related to those casinos the tourists flock to.

Special water police library fire prevention redevelopment etc. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. Checks for real property tax payments should be made payable to Clark County Treasurer.

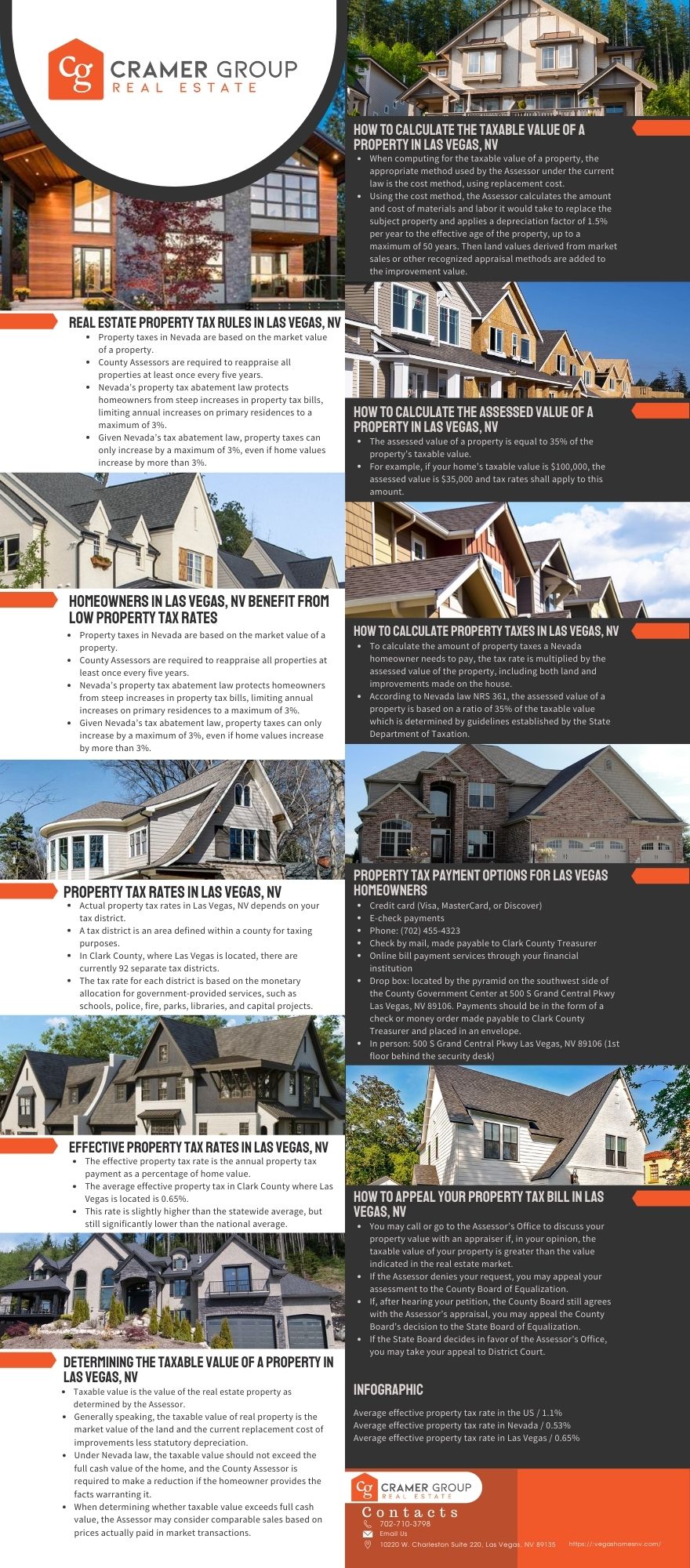

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. However the property tax rates in Nevada are some of the lowest in the US. You can see from the table above that the sales tax in Las Vegas is a combination of Nevada state sales tax and Clark Countys sales tax.

Contact the Assessors Office at 702-455-4970 for payment options. We are open 730 am. Skip to main content.

111-11-111-111 Address Search Street Number Must be Entered. Property Tax Rates for Nevada Local Governments Redbook. Property taxes in Nevada pay for local services such as roads schools and police.

NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. To qualify the Veteran must have an honorable separation from the service and be a resident of Nevada. Office of the County Treasurer.

The average lot size on Granite Mountain Ln is 22024 ft2 and the average property tax is 41Kyr. The New Business Checklist can provide you a quick summary of which licenses youll need estimated cost and time to obtain licensing. If you received a Commerce Tax Welcome Letter Click Here.

The political action group Fund Our Schools backed by the Clark County Education Association submitted. Las Vegas NV 89106. The amount of exemption is dependent upon the degree of disability incurred.

Pay fees for permits licenses sewer bills Municipal Court citations parking tickets and more. The average effective property tax in the county is 065 slightly higher than the statewide. Account Search Dashes Must be Entered.

January 16 2020. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Real Property Tax Payment Schedule Nevada.

Taxes are delinquent 10 days after due date. May 31 2022. Las Vegas NV 89155-1220.

Las Vegas City Hall. Combined Sales Tax in Las Vegas. Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60.

The property tax rates in Nevada are some of the lowest in the nation. The surviving spouse of a disabled. Make health care more affordable for millions of seniors and others with serious illnesses by capping the amount they pay out-of-pocket for prescription drugs under.

We encourage taxpayers to pay their real property taxes using our online service or automated phone system. The average property on Granite Mountain Ln was built in 1993 with an average home value of 149057. In addition to basic city taxes many districts have additional percentages to pay for the specific needs of the area.

What taxes do Nevada residents pay. Clark County contains almost 75 of the states residents and includes Las Vegas. To ensure timely and accurate posting please write your parcel numbers on the check and include your payment coupons.

123 Main St City State and Zip entry fields are optional. Office of the County Treasurer. Property Account Inquiry - Search Screen.

Click here to schedule an appointment. 3rd Quarter Tax Due - 1st Monday of January. Failure to receive a tax bill does not relieve the responsibility for timely.

Accounts that are currently in seizure status cannot be paid on this page. 702 455-4323 Fax 702 455-5969. Clark County Tax Rate Increase - Effective January 1 2020.

Please verify your mailing address is correct prior to requesting a bill. Ask the Advisor Workshops. 500 S Grand Central Pkwy 1st Floor.

This sales tax rate went into effect on January 1 2020. Combined Sales Tax Rate for Purchases in Las Vegas. The average effective property tax rate in Nevada is 053 while the national average is 107.

In Las Vegas NV the estimated annual property taxes can be calculated at roughly 5 to 75 of the home purchase price. Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general. You may pay in person at 500 S Grand Central Pkwy Las Vegas NV 89106 1st floor behind the security desk.

If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323 option 3. 4th Quarter Tax Due - 1st Monday of March. LAS VEGAS AP Just days after beginning an initiative drive to increase casino taxes Las Vegas-area teachers filed a petition to increase Nevada sales taxes and raise more than 1 billion per year for schools.

Register File and Pay Online with Nevada Tax. The Clark County Assessors Office does not store your sensitive credit card information. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more.

View or Pay Taxes. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Las Vegas itself does not have its own sales tax rate.

Las Vegas NV 89106. 17 hours agoLas Vegas Sun. Las Vegas NV 89106.

The Cost Of Living In Las Vegas Upnest

Nevada Tax Rates And Benefits Living In Nevada Saves Money

What S The Property Tax Outlook In Las Vegas Mansion Global

Need To Sell Your Home Fast With A Las Vegas Cash Buyer You Can Sell Your House Quickly In As Is Condition And Cash Buyers Sell Your House Fast Nevada Homes

The Venetian Casino Property Map Floor Plans Las Vegas Venetian Las Vegas Las Vegas Trip Las Vegas Vacation

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Taxpayer Information Henderson Nv

Taxpayer Information Henderson Nv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Pool Sale Hulope Plunge Pool Inground Semi Inground Pool Only 2 900 Visit Us Direct Pools Spas 120 E Bruner Ave Suite 175 Las Vegas Nv 89183 70

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

North Las Vegas Real Estate Snapshot Las Vegas Real Estate Nevada Real Estate Boulder City

House Hunting Rental Properties Across The Nation Rental Property Buying Investment Property Real Estate Investing Rental Property

15 9 Million J2 Residence 7 Sable Ridge Ct Las Vegas Nevada Modern House Plans Modern House House Plans

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

12 Cities 12 Slaries 12 Median Home Prices Blog Phmc Com Salary Needed To Afford A Median Home Price With A 10 House Prices Home Mortgage Charlotte News

Moving To Las Vegas Here Are 15 Things To Know Extra Space Storage